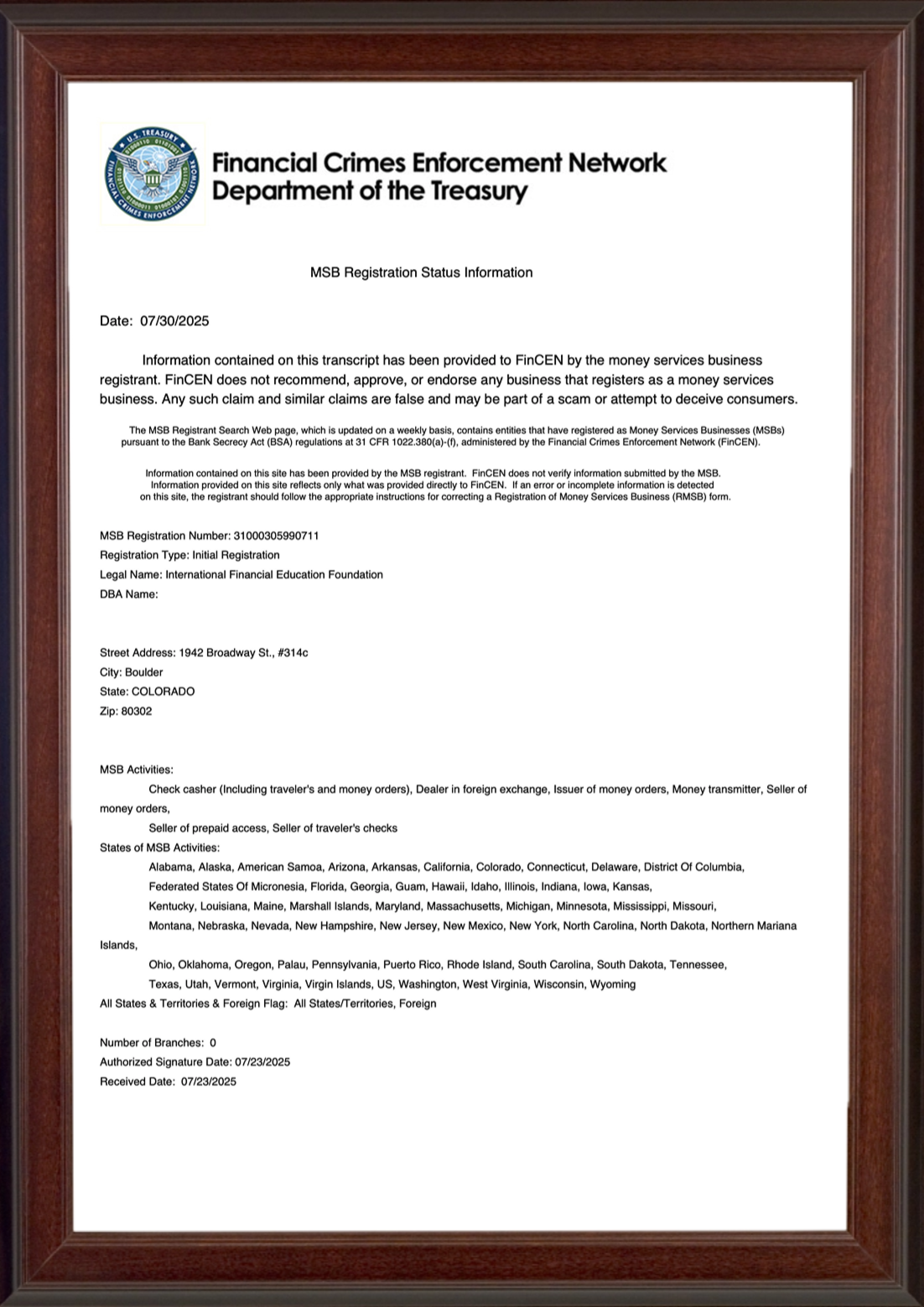

IFEF officially receives the US MSB Financial Services License

🔹 Issuing Authority: FinCEN – Financial Crimes Enforcement Network of the US Department of the Treasury

🔹 License Type: Money Services Business (MSB – Financial Services Business)

🔹 Registration Number: 31000305990711

🔹 Status: Active

We are delighted to announce that IFEF has officially received its US MSB license – a significant milestone in our global compliance strategy. This license confirms our ability to offer compliant, secure, and trustworthy services in cross-border FinTech and education applications.

The license authorizes us to carry out the following activities, among others: Proof of regulated business activity: As a non-profit organization, IFEF now has official authorization to offer relevant financial services in the US – including payment tools for educational platforms and digital systems for trade support.

Legal certainty for AI-powered financial technologies: Our core system, Alturyon X, covers areas such as cross-border strategy development, data processing, and education-oriented investment analytics. The MSB certification strengthens international partners' trust in our technology and improves market acceptance.

Foundation for global partnerships: Especially in Germany and across Europe, the MSB license provides a crucial legal foundation for in-depth collaboration with banks, universities, and public institutions.

"We are convinced that technology can transform the financial sector – but only with consistent regulation and sound education can this change be sustainable and inclusive. Obtaining the MSB license is not only recognition of our previous work, but the starting point for a new chapter in global financial education."

— The IFEF Professors' Council